unlevered free cash flow margin

Colgate-Palmolives operated at median unlevered free cash flow margin of 179 from fiscal years ending December 2017 to 2021. Looking back at the last five years Costco Wholesales.

It is the cash flow available to all equity.

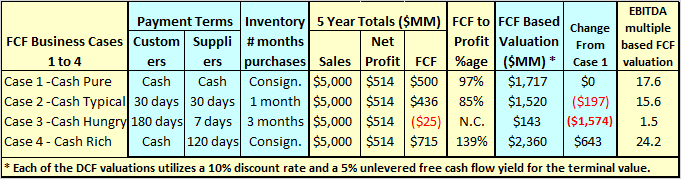

. After accounting for interest payments the levered free cash flow of a firm may actually be negative a possible. Levered cash flow is the amount of money your business has left over after paying all bills and other financial obligations including operating expenses interest payments etc. Unlevered free cash flow UFCF is the cash flow available to owners of all sources of capital equity-holders mezzanine financing owners and debtholders.

Costco Wholesales operated at median unlevered free cash flow margin of 20 from fiscal years ending September 2018 to 2022. Toyota Motors unlevered free cash flow margin for fiscal years ending March 2018 to 2022 averaged -11. It represents cash available to all capital providers.

Coca-Colas latest twelve months unlevered free cash flow margin is 234. The company expects to generate unlevered free cash flow FCF of 570 million from its Midland bolt-ons. Unlevered free cash flow can be used to make informed decisions about a business or investment opportunity by evaluating the companys ability to generate cash flow.

View PT Surya Citra Media Tbks Unlevered Free Cash Flow Margin trends charts and more. Companies looking to demonstrate better numbers can manipulate unlevered free cUnlevered free cash flow is computed before interest payments so viewing it in a bubble ignores the capital structure of a firm. What Is Free Cash Flow FCF.

Unlevered free cash flow is the amount of cash a company has prior to making its debt payments. Looking back at the last five years Colgate-Palmolives. PT Surya Citra Medias latest twelve months unlevered free cash flow margin is -100.

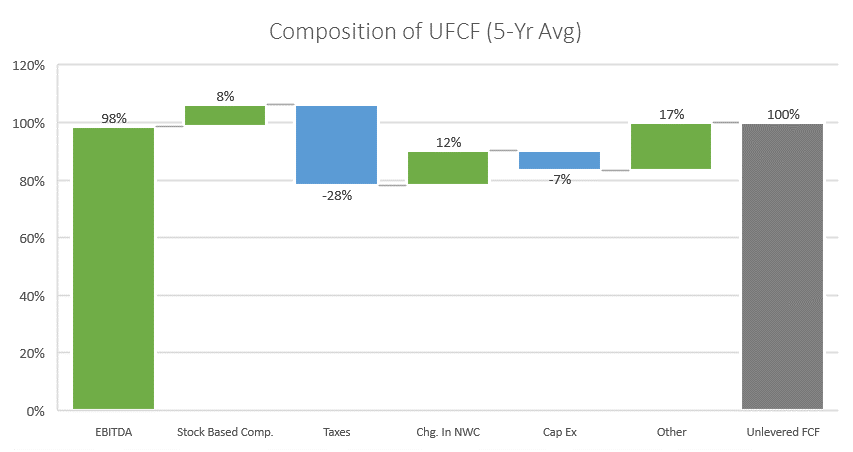

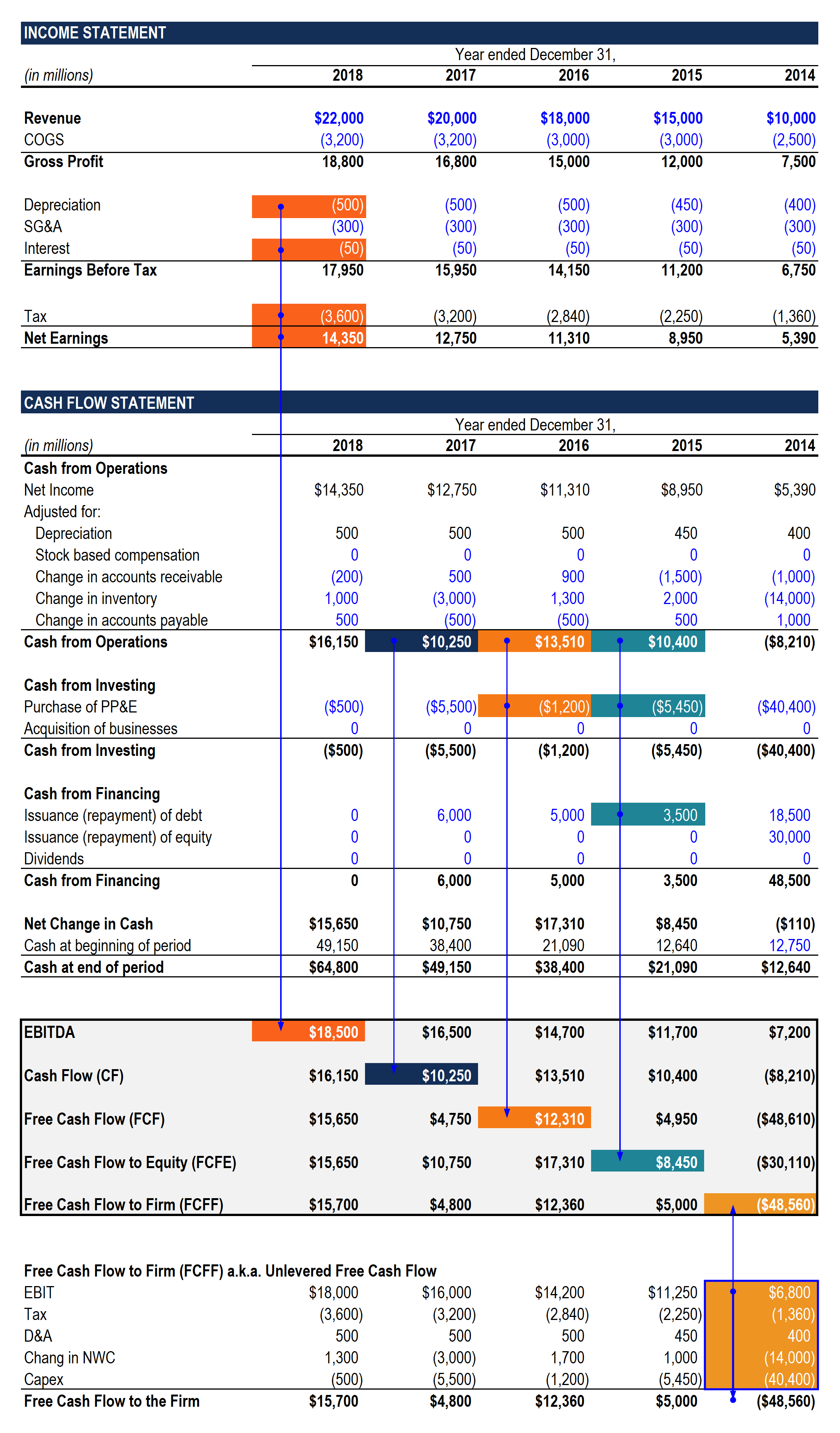

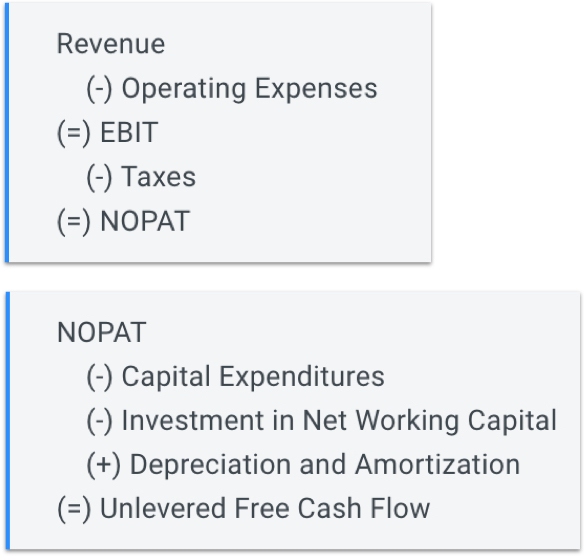

In both deals Diamondback will immediately tap the brakes. Unlevered free cash flow gross cash flow free cash flow to firm FCFF before any interest payments on debt obligations. UFCF is calculated as EBITDA minus CapEx minus working capital minus.

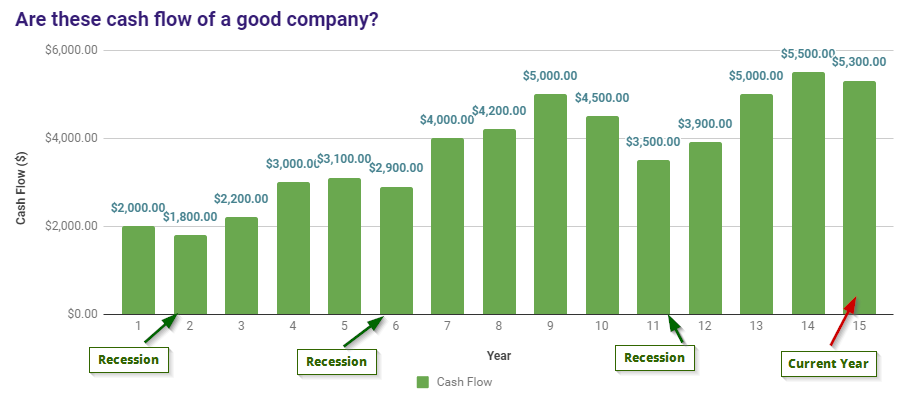

Free cash flow FCF represents the cash that a company generates after accounting for cash outflows to support operations and maintain its. Levered free cash flow net cash flow. Teslas operated at median unlevered free cash flow margin of 36 from fiscal years ending December 2017 to 2021.

It represents the cash. Looking back at the last five years Teslas unlevered free cash flow. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Microsofts unlevered free cash flow margin for fiscal years ending June 2018 to 2022 averaged 311. Levered Free Cash Flow LFCF includes both interest expenses and debt principle payments. Unlevered Free Cash Flow Margin means total Unlevered Free Cash Flow for the current fiscal year minus the Board - approved pro forma Unlevered Free Cash Flow for.

View The Coca-Cola Companys Unlevered Free Cash Flow Margin trends charts and more. Toyota Motors operated at median unlevered free cash flow margin of. Microsofts operated at median unlevered free cash flow margin of 306 from fiscal.

Unlevered Free Cash Flow is the cash generated by a company before accounting for interest and taxes ie. Unlevered Free Cash Flow UFCF excludes interest expense and debt principle payments.

Unlevered Free Cash Flow Definition Examples Formula

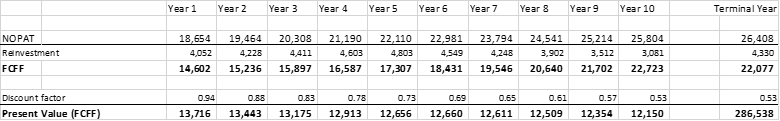

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Unlevered Free Cash Flow Ufcf Formula And Calculation

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Free Cash Flow Yield Formula And Calculation

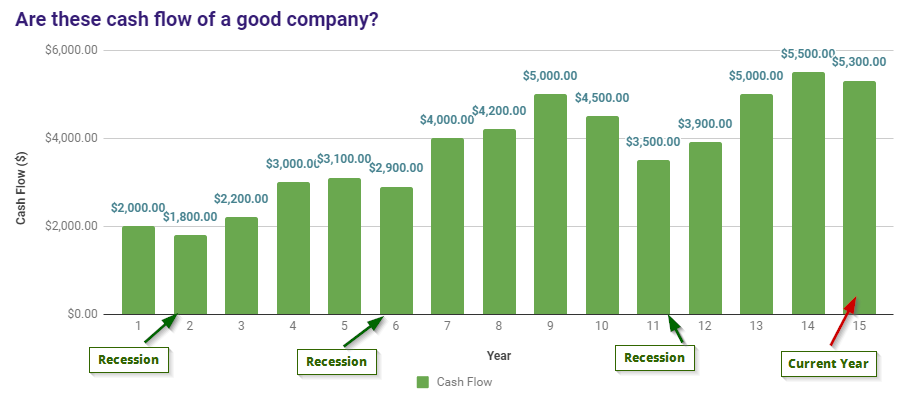

How To Do Cash Flow Analysis The Right Way Ir

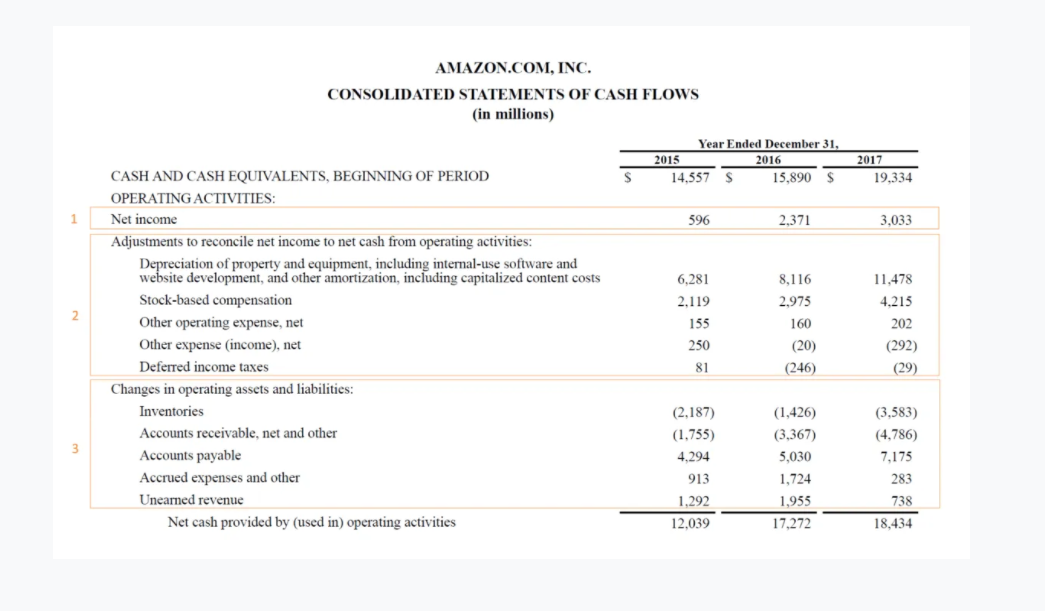

Cash Flow Formula How To Calculate Cash Flow With Examples

An Undervalued Free Cash Flow Generator To Start Your New Year Activision Blizzard Nasdaq Atvi Seeking Alpha

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

Free Cash Flow From Ebitda How To Calculate

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow Yield Formula And Calculation

Net Profit Ebitda Operating Cashflow And Free Cashflow In Dividend Investing

Rule Of 40 Saas Valuation Free Cash Flow

Free Cash Flows Let S Have A Discussion Towards A Better Understanding Seeking Alpha

Cash Flow Analysis Basics Benefits And How To Do It Netsuite

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

:max_bytes(150000):strip_icc()/freecashflowpershare_final-828d06f0dd0d49bea34c55877a29e98a.png)

:max_bytes(150000):strip_icc()/Term-Definitions_freecashflow-5ec66f512895463a9f344f752fa3ce24.png)